What RFK Jr.’s Financial Disclosures May Teach Us About Managing Debt

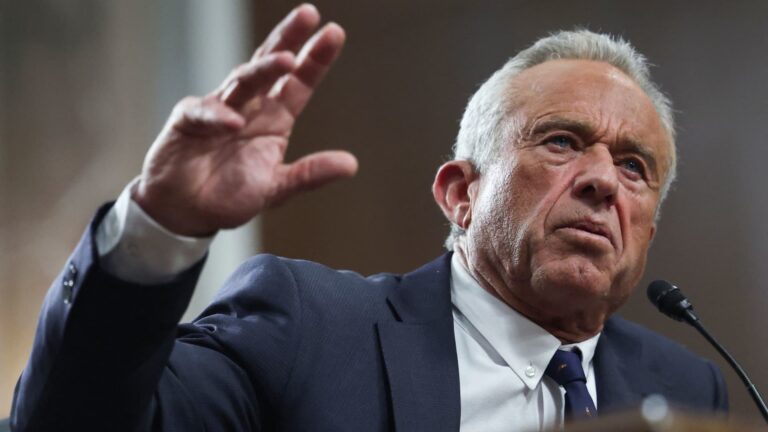

In the world of personal finance, the actions and choices of public figures can serve as powerful teaching moments. One such figure is Robert F. Kennedy Jr. (RFK Jr.), whose recent financial disclosures provide valuable insights into debt management and financial literacy. By analyzing these disclosures, we can glean useful lessons about balancing income, debt, and the principles of financial responsibility.

Understanding RFK Jr.’s Financial Landscape

RFK Jr. has been a prominent voice in many debates, but his financial standing has come under scrutiny due to his debt levels and assets. In his financial disclosure form, he reported significant liabilities alongside substantial assets. According to recent data, the average American household carries approximately $8,000 in credit card debt, while many families carry larger loans for student debt, cars, and mortgages.

These figures highlight a critical reality: debt is a common aspect of financial life. However, understanding how to navigate it effectively is essential for financial health. RFK Jr.’s financial disclosures reveal both the challenges of managing debt and effective strategies for maintaining financial stability.

Lesson 1: Know Your Financial Position

One of the fundamental lessons from RFK Jr.’s financial disclosures is the importance of an accurate assessment of your financial position. Before managing debt, it is crucial to know where you stand.

A 2021 study found that nearly 60% of Americans do not have a budget. Budgeting helps clarify income sources, expenses, and liabilities, which is crucial for making informed decisions about debt repayment. By maintaining a clear picture of your finances, you can prioritize debts, track your spending, and allocate resources effectively.

Lesson 2: Prioritize Debt Repayment

RFK Jr.’s financial woes also highlight the significance of prioritizing debt repayment. In the case of increasing liabilities, focusing on high-interest debts first—such as credit card debts—can save you money in the long run. A survey by the National Foundation for Credit Counseling revealed that approximately 53% of Americans have made late payments on their debts.

This delay can lead to additional penalties and interest, creating a detrimental cycle. By setting up a debt repayment plan, individuals can stay on track and mitigate further financial strain. A recommended approach is the “debt snowball method,” where smaller debts are paid off first, leading to psychological rewards that motivate continued progress.

Lesson 3: Diversification of Income

Another key takeaway from RFK Jr.’s disclosures is the importance of diversifying income sources. While it is not uncommon for individuals to rely on a single job for income, diversifying your income streams can act as a safety net.

According to the Bureau of Labor Statistics, nearly 10% of workers engage in some form of self-employment. With the rise of the gig economy, individuals can now explore freelance opportunities or side hustles to supplement their income. This additional income can aid in managing debt and providing a buffer during uncertain economic times.

Lesson 4: Seek Financial Guidance

RFK Jr.’s experience underscores the value of seeking professional financial guidance. Many people feel overwhelmed by their debts and may lack the expertise to develop a successful financial strategy.

A 2022 survey revealed that 73% of Americans wished they had consulted a financial advisor sooner. Financial literacy is crucial; however, seeking help from professionals can clarify debt management strategies, investment opportunities, and budgeting techniques that align with personal financial goals.

Conclusion: Taking Control of Your Finances

RFK Jr.’s financial disclosures raise critical awareness about debt management and the lessons we can learn from them. By understanding your financial position, prioritizing debt repayment, diversifying income, and seeking professional guidance, anyone can navigate through significant financial challenges.

These steps not only foster clarity and control over one’s finances but also contribute to building a secure financial future. As we analyze public figures like RFK Jr., we can extract vital lessons to help us forge paths to financial success amidst the complexities of debt.

Remember, financial literacy is an ongoing journey, and by incorporating best practices into your daily life, you can better control your financial destiny.