Getty Images

Getty ImagesIt has not been a good week for Chancellor Rachel Reeves.

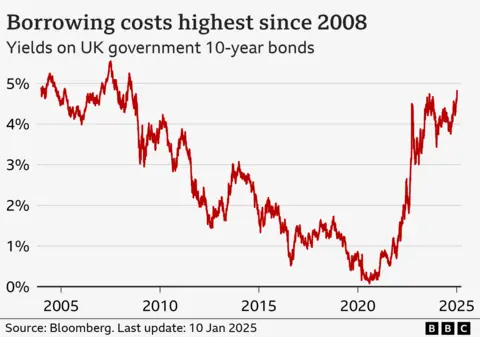

Government borrowing costs have hit their highest level in 16 years and the pound has fallen to a 14-month low against the dollar.

She has gone on a planned trip to China amid accusations from opposition parties that she is leaving at a moment of economic peril.

Bank of England governor Andrew Bailey is accompanying her on the trip. The 12-hour flight to Beijing is probably the length of the meeting she might have wanted to have with him.

So how serious are the recent movements on the markets and what could happen as a result?

Budget plans need to be tweaked

While the markets stabilised from Thursday lunchtime, the move against UK government debt is already enough to cause a problem for the chancellor’s Budget maths.

Reeves has pledged not to borrow to fund day-to-day spending and to get debt falling as a share of national income by the end of this parliament. The Treasury has said these fiscal rules, set out in the Budget, are “non-negotiable”.

At times over the past week the markets have looked pretty fragile for Britain, with both government borrowing costs going up and sterling falling back at the same time. That is a key marker.

While it’s true that the overall direction for the markets over the past month has been set by an assessment of the inflationary consequences of President-elect Trump’s trade and economic policies, the UK has been getting some special attention in addition.

It risks being tarred with both the inflationary stickiness of the US, and the stagnant growth of the eurozone – the worst of both worlds.

That said, it is important to be precise about the extent of the problem. The extra cost of servicing the national debt at these interest rates would be several billion pounds a year – i.e. material enough to require some sort of correction in the Budget maths, but doable, and the clear message this week is that “it will be done”.

No impact on mortgages so far

The impact on budgetary maths is real, but the wider impact that might be expected – of higher borrowing costs for companies and for households – has not yet materialised.

The mortgage market has yet to see an increase in rates for fixed-term mortgages, as occurred rapidly in the panic after the 2022 mini-Budget. There is a curious calm.

One explanation lies in what is not happening. This time last year the major lenders greatly discounted mortgages in a battle for market share ahead of the key moments for house buying. This has not happened this year, and may yet have a consequence in the property market.

The Bank of England has indicated it will continue with interest rate cuts this year. The markets think there may be far fewer than previously expected, perhaps only one, leaving base interest rates at 4.5%.

Many economists say this is the wrong call, and believe rates will be cut multiple times. There’s quite a lot of uncertainty here, and the key Bank of England committee is split. The Bank’s words will be very carefully watched.

More positively for the economy, despite a lot of rhetoric from retailers, many have delivered strong results and have not lowered their profits expectations. Are consumers a bit more robust than had been assumed, and could this drive some growth in 2025?

Growth strategy needs a reboot

The problem of servicing higher interest payments on the national debt increases the likelihood of the Treasury making plans for an adjustment, based on a squeeze on spending. A £10bn cut will hurt, but with a majority of 170 MPs in the House of Commons, and an ongoing spending review already in train, it can be done.

In these circumstances, with the credible threat of a global trade war, for example, it should be noted that Rachel Reeves’ new fiscal rules do have an escape hatch.

In the event of “an emergency or a significant negative economic shock to the economy” the chancellor may “temporarily suspend the fiscal mandate”.

While a global trade war could qualify, it would be difficult optics to suspend a “non-negotiable” and “iron-clad” set of rules before they had really bitten. The rules have not yet formally passed into law yet either, and remain a “draft” until the Commons votes to approve them.

It seems very unlikely that this route will be taken unless there is a very clear economic shock in the coming weeks.

The bigger point here is what matters in the markets, which is whether the UK is pursuing a credible set of policies, a convincing overall strategy.

Labour’s focus on stability at all costs was understandable after the humiliation of Liz Truss’s mini-Budget. But “stability” is not a growth strategy.

Pursuing green growth by borrowing for long-term capital investment is a potential strategy, and it underpinned “Bidenomics” in the US. The incoming government embraced the rhetoric of US policy under the outgoing president, without the same firepower. “Bidenomics without the money”, you might say.

But now the new Trump administration is jettisoning this approach, rightly or wrongly, and the markets are less convinced that such a strategy will pay for itself. It will cost more to fund such a strategy, and require harsher trade-offs than expected.

Bidenomics without the money and without Biden is much too thin. A more detailed strategy for sustained growth is needed, and in short order.